The 10-Minute Rule for Bankruptcy Lawyer Tulsa

People must make use of Phase 11 when their financial obligations surpass Phase 13 financial obligation limitations. Phase 12 personal bankruptcy is designed for farmers and anglers. Chapter 12 payment plans can be more adaptable in Chapter 13.

The methods test looks at your ordinary regular monthly earnings for the six months preceding your filing day and compares it against the typical revenue for a similar house in your state. If your earnings is listed below the state typical, you immediately pass and do not have to finish the whole kind.

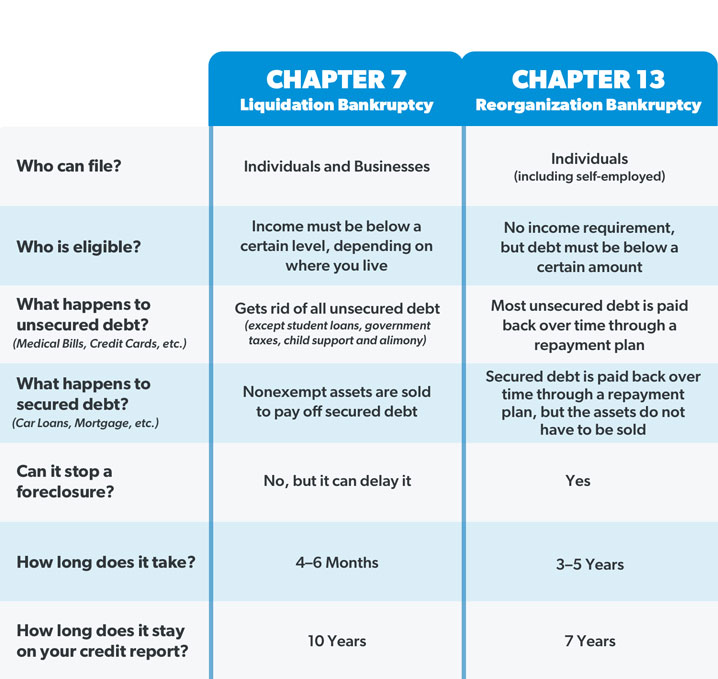

The financial debt limitations are detailed in the graph above, and current quantities can be confirmed on the United State Courts Chapter 13 Insolvency Basics page. Find out more regarding The Means Examination in Chapter 7 Personal bankruptcy and Debt Boundaries for Phase 13 Bankruptcy. If you are married, you can submit for bankruptcy collectively with your partner or separately.

Declaring personal bankruptcy can aid a person by throwing out financial debt or making a plan to pay back financial obligations. An insolvency case typically starts when the borrower files a request with the bankruptcy court. An application might be submitted by an individual, by partners together, or by a firm or other entity. All bankruptcy situations are handled in federal courts under guidelines outlined in the U.S

Declaring personal bankruptcy can aid a person by throwing out financial debt or making a plan to pay back financial obligations. An insolvency case typically starts when the borrower files a request with the bankruptcy court. An application might be submitted by an individual, by partners together, or by a firm or other entity. All bankruptcy situations are handled in federal courts under guidelines outlined in the U.SBankruptcy Law Firm Tulsa Ok - Questions

There are different sorts of insolvencies, which are generally described by their phase in the U.S. Insolvency Code. Individuals may file Phase 7 or Chapter 13 personal bankruptcy, depending on the specifics of their scenario. Municipalitiescities, communities, villages, exhausting areas, community energies, and school areas might submit under Phase 9 to rearrange.

If you are dealing with economic challenges in your personal life or in your organization, possibilities are the concept of declaring insolvency has actually crossed your mind. If it has, it also makes good sense that you have a great deal of insolvency inquiries that require responses. Lots of people really can not answer the concern "what is insolvency" in anything except general terms.

Many individuals do not realize that there are several kinds of insolvency, such as Chapter 7, Chapter 11 and Chapter 13. Each has its benefits and challenges, so recognizing which is the ideal alternative for your present circumstance as well as your future recuperation can make all the distinction in your life.

Chapter 7 is termed the liquidation bankruptcy phase. In a chapter 7 bankruptcy you can get rid of, clean out or release most types of debt.

Little Known Questions About Top Tulsa Bankruptcy Lawyers.

Numerous Chapter 7 filers do not have a lot in the method of properties. They may be renters and have an older cars and truck, or no cars and truck in all. Some cope with parents, buddies, or brother or sisters. Tulsa bankruptcy attorney. Others have residences that do not have much equity or remain in major requirement of repair service.

Creditors are not permitted to go after or maintain any collection tasks or suits throughout the situation. A Chapter 13 insolvency is really powerful since it gives a device for debtors to avoid foreclosures and sheriff sales and quit repossessions and energy shutoffs while capturing up on their protected debt.

A Phase 13 case may be beneficial because the debtor is enabled to obtain caught up Tulsa bankruptcy lawyer on home mortgages or vehicle loan without the threat of foreclosure or repossession and is allowed to maintain both exempt and nonexempt residential or commercial property. Tulsa bankruptcy lawyer. The debtor's plan is a paper outlining to the insolvency court just how the debtor suggests to pay present expenditures while settling all the old financial obligation equilibriums

It provides the debtor the possibility to either sell the home or end up being captured up on home loan repayments that have fallen back. An individual filing a Phase 13 can suggest a 60-month plan to cure or end up being present on mortgage repayments. As an example, if you fell behind on $60,000 well worth of home loan payments, you might recommend a plan of $1,000 a month for 60 months to bring those mortgage settlements present.

It provides the debtor the possibility to either sell the home or end up being captured up on home loan repayments that have fallen back. An individual filing a Phase 13 can suggest a 60-month plan to cure or end up being present on mortgage repayments. As an example, if you fell behind on $60,000 well worth of home loan payments, you might recommend a plan of $1,000 a month for 60 months to bring those mortgage settlements present.Some Known Details About Tulsa Bankruptcy Legal Services

Sometimes it is better to prevent personal bankruptcy and settle with lenders out of court. New Jersey additionally has an alternative to insolvency for organizations called an Assignment for the Benefit of Creditors (Tulsa bankruptcy attorney) and our legislation company will certainly look at this alternative if it fits as a possible technique for your organization

We have created a tool that helps you choose what chapter your file is most likely to be filed under. Go here to use ScuraSmart and learn a possible solution for your debt. Lots of people do not recognize that there are a number of kinds of insolvency, such as Chapter 7, Chapter 11 and Phase 13.

The Ultimate Guide To Chapter 13 Bankruptcy Lawyer Tulsa

Here at Scura, Wigfield, Heyer, Stevens & Cammarota, LLP we take care of all sorts of bankruptcy instances, so we are able to address your insolvency questions and assist you make the best choice for your case. Below is a short look at the financial obligation relief choices available:.

You can only submit for bankruptcy Prior to filing for Chapter 7, at least one of these need to be real: You have a great deal of debt revenue and/or possessions a financial institution can take. You have a great deal of debt close to the homestead exemption quantity of in your home.

Hanson & Hanson Law Firm, PLLC

Address: 4527 E 91st St, Tulsa, OK 74137, United StatesPhone: +19184090634

Click here to learn more